Take your technical analysis and chart reading skills to another level by learning Heikin Ashi, Elliott Wave Theory and harmonic price patterns.

5

5Summer School

Heikin Ashi

1

What is Heikin Ashi?

Learn what Heikin Ashi is and how this trendy candlestick chart can help traders who like their prices smooth.

2

Heikin Ashi Candlestick Chart vs. Traditional Japanese Candlestick Chart

Learn the difference between Heikin Ashi candlestick charts versus traditional Japanese candlestick charts.

3

How to Calculate Heikin Ashi

Learn how Heikin Ashi candlesticks are calculated.

4

How to Use a Heikin Ashi Chart

How do you use Heikin Ashi? Learn how to use and read a Heikin Ashi candlestick chart.

5

How to Trade Using Heikin Ashi

How do you trade Heikin Ashi? Learn how to trade forex and other markets using Heikin Ashi charts.

6

Limitations of Heikin Ashi

Heikin Ashi is great for identifying trend direction and trend strength but it does have some weaknesses and limitations

7

Heikin Ashi Cheat Sheet

Here’s a summary of what you need to remember about Heikin Ashi. We review what Heikin Ashi is, how to calculate Heikin Ashi and the advantages and disadvantages of using it.

Elliott Wave Theory

1

Elliott Wave Theory

Amidst all the chaos in the market, Mr. Elliott found order. The Elliot Wave Theory gives us a way to identify highly probable points where price is most likely to reverse.

2

Impulse Waves

According to Elliot, a trending market moves in a 5-3 pattern. Find out what that means here.

3

Corrective Waves

The Zig-Zag, the Flat, and the Triangle are all types of ABC correction wave formations.

4

Fractals: Elliott Waves Within an Elliott Wave

Always remember that each wave is comprised of smaller wave patterns and that this pattern tends to repeat itself FOREVER.

5

3 Cardinal Rules of the Elliott Wave Theory

Before you jump right into applying the Elliott Wave Theory to your trading, you must take note of the following three cardinal rules.

6

How to Trade Forex Using Elliott Waves

Enough jibberjabber – it’s time to see the real thing! Here’s how you can apply Elliott Waves in trading.

7

Summary: Elliott Wave Theory

Before you test your Elliott Wave skills in trading, make sure you’ve got its basics down to a tee.

Harmonic Price Patterns

1

Harmonic Price Patterns in the Forex Market

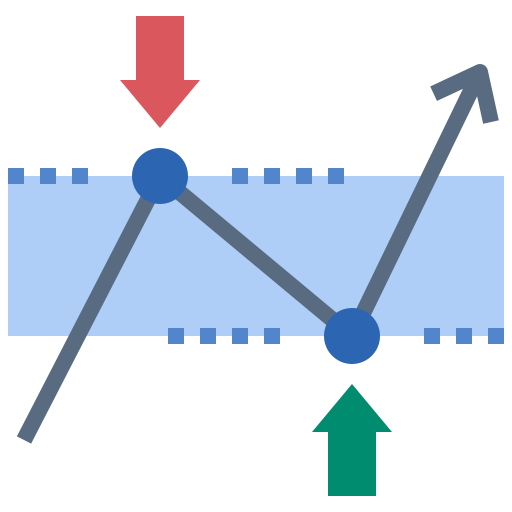

Harmonic price patterns are all about retracements. Let’s jump back into some trends!

2

The ABCD and the Three-Drive

With the Fibonacci retracement tool, making pips can be as easy as A-B-C. Seriously!

3

Trading The Gartley Pattern

Learn about a super smart dude’s solution to two of the biggest problems of traders: what and when to buy.

4

3 Steps to Trading Harmonic Price Patterns

Trading Harmonic Price Patterns is as easy as 1-2-3! Locate the potential price pattern, measure it, and then buy or sell upon its completion!

5